Price Your Product to Capture the Value You Create

Are you leaving money on the table by pricing products based on costs?

Contents

Markets Don’t Set Prices

According to Wharton marketing professors Jagmohan Raju and John Zhang, most companies either price their products and services based on their costs, or their competitors. They fail to capture the value they create for their customers. When asked how they set their prices, many executives throw their hands up the air and say, we don’t set the prices, markets do.

They are wrong. Markets don’t set prices; marketers do.

In their book titled Smart Pricing, Raju and Zhang say that most companies do not think strategically about pricing. Instead, pricing is an afterthought, often set to achieve a certain level of profits based on total costs incurred, or based on the market-leading products’ prices.

What businesses are missing is a clear understanding of their customers’ willingness to pay. Clearly, a customer is not going to tell you that he will pay more for your product than what you are asking. Besides, customers in different segments will have different price points in their mind, based on your customer value proposition, your brand, channel, availability, etc.

Most firms set prices based on one of the following approaches:

- Cost-Plus Pricing: This is probably the most common approach to pricing a product or service. A firm simply calculates its unit cost and applies a pre-determined markup to set the price. This markup reflects the firm’s desired profitability. Costco is famous for this approach, and reportedly has a maximum markup of 14%. The consumers know they are getting a great price, and Costco enjoys a predetermined gross margin.

- Competition-Based Pricing: Another common approach is to price products based on what the competition charges. Neighboring gas stations are notorious for being within a fraction of a cent of each other since brand differentiation in gas prices is very difficult. Airlines follow a similar approach, quickly matching each other’s price increases or decreases. Many service industries such as hotels price their products within a narrow band vs. their immediate competition. Competition based pricing often leads to price wars. In competition-based pricing, large competitors tend to drive out smaller ones since their fixed costs are spread across a larger customer base.

- Consumer Based Pricing: This approach is based on sizing up each customer’s willingness to pay and then negotiating a price that the customer will accept. Car dealerships often use this approach. The sticker price is nothing but the best price a dealer hopes the customer will pay. As a customer shows interest and kicks the tires, the sales rep sizes up the customer’s willingness to pay. The customer is offered a discount to close the deal if the sale happens right then, thus creating a sense of urgency. Good negotiators can walk away with better deals than those not well-versed in the art of negotiation, or who have less information about what the same product may cost elsewhere.

Impact of Pricing on Profitability

There are four ways a firm can increase its profits:

- Increase sales volume

- Decrease variable costs

- Decrease fixed costs

- Increase prices

Firms invest in salesforce infrastructure and sales personnel, as well as in branding and advertising, to increase sales volume. They are constantly working to decrease variable costs, i.e. costs that are directly attributable to the volume of products or services sold. For example, the actual costs of the ingredients in a product are part of variable costs. Firms also work to decrease fixed costs such as the cost of infrastructure like buildings or machinery that produce the goods, and the cost of support personnel such as human resources and IT.

A Wharton Research Data Service study quoted by Raju and Zhang in their book Smart Pricing found that if a firm could increase its sales by 1% without any change in its cost structure, its profitability would increase by 3.3%. A 1% reduction in fixed costs would lead to an increase in profitability by 2.5%. A 1% reduction in variable costs would lead to a profit increase of 6.5%. But a 1% increase in price with other costs remaining the same would increase profitability by 10.3%.

A price increase is the most important lever a company can employ to increase profitability. However, most firms are very reluctant to increase their prices, because of the fear that their customers will leave them for rivals. The law of supply and demand would come into play, and consumers will choose a lower-priced alternative. This fear of losing customers is rooted deeply in the fact that most businesses do not understand how to quantify the value they create for their customers.

Pricing from a Value Perspective

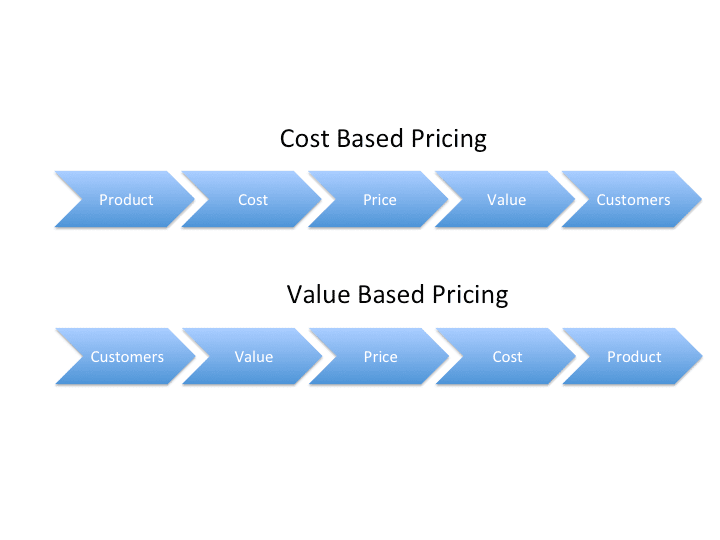

Warren Buffett famously said: “Price is what I pay. Value is what I get.” So how does value-based pricing work? The next illustration shows the difference between cost-based and value-based pricing:

The cost-based pricing process begins with the product cost, and a price is set before taking the value created for customers into consideration. Value-based pricing process does the opposite. It begins with the customer. A firm needs a very clear understanding of the customer segments it serves, and the specific value it creates for each segment. It then prices its product or service based on the value it creates. When the focus is on value created, the product cost becomes a secondary consideration.

Creating a Value Surplus

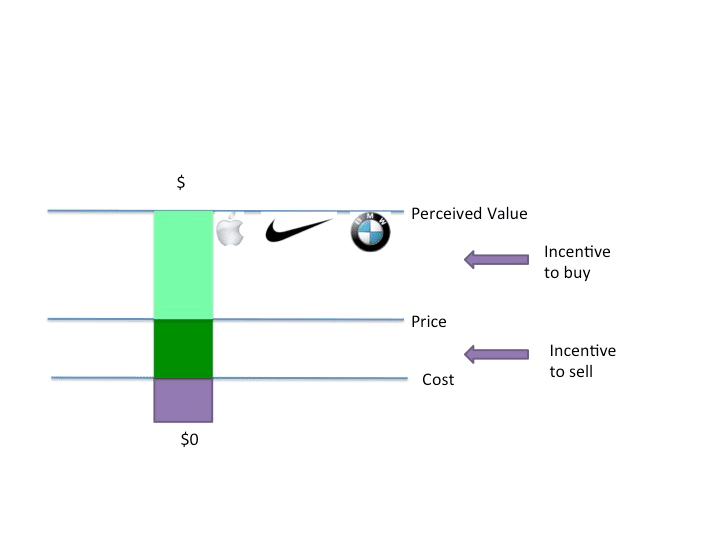

When a firm has a clear understanding of the value it creates for a customer, it creates an incentive for the customers to buy its product. The next illustration shows the value to cost relationship:

When a firm prices its product above its cost, it is driven by an incentive to sell the product at a reasonable margin. However, a customer’s perception of the value derived from the product is different from the price she is paying. The perceived value of the product may be much higher than the price a firm is charging. The gap between perceived value and the price paid is the incentive to buy. Great brands such as Apple, Nike, and BMW create a much higher perceived value than what a customer pays for their products. The value surplus they create is reflected in strong customer loyalty to their brand, as well as in their stock prices.

Ideally, a firm should create as much value surplus as it can, so it has the headroom to increase its prices. Recently, Netflix decided to raise its monthly prices for new customers by $1 in the US, and $2 internationally. In order to reward its current user base for their loyalty, it told them their pricing would not rise for an additional two years. This creates an incentive for the customers to stay with the firm since they believe they are being rewarded for their loyalty.

Similarly, Amazon recently raised the price of its Amazon Prime service from $69 to $99 annually. Since the price includes unlimited 2-day shipping of orders, free streaming of 40,000 movies & TV episodes, and free borrowing of 500,000 Kindle book titles, the perceived customer value is much higher than the price paid.

Costco recently raised its membership prices by 10%. Since its customers believe they are receiving good value from Costco, it did not result in customers leaving the membership warehouse. By contrast, competing warehouses such as Sam’s Club and BJ’s have lower annual membership fees since their customers are more price-sensitive. Costco pays its employees significantly more than its competition. It also has nearly twice the sales per square foot in its stores compared to Sam’s Club. It has attracted a less price-sensitive but more value-conscious customer segment than its competitors.

For entrepreneurs, the message is clear. Price your products and services based on the value you create. Focus on creating significant value by eliminating customer pains and augmenting customer gains. Then the value you deliver will create a win-win situation for both you and your customers.