Will Your Business Model Deliver?

In this age of the lean startup, minimum viable product, and fail fast, the advice is clear, test everything as soon as possible. Also, do it while making the smallest possible investment. This raises questions such as: am I as lean as I need to be, is my product too minimal, and will I fail? There are tools to help you go lean and avoid the “fail” part of “fail fast.”

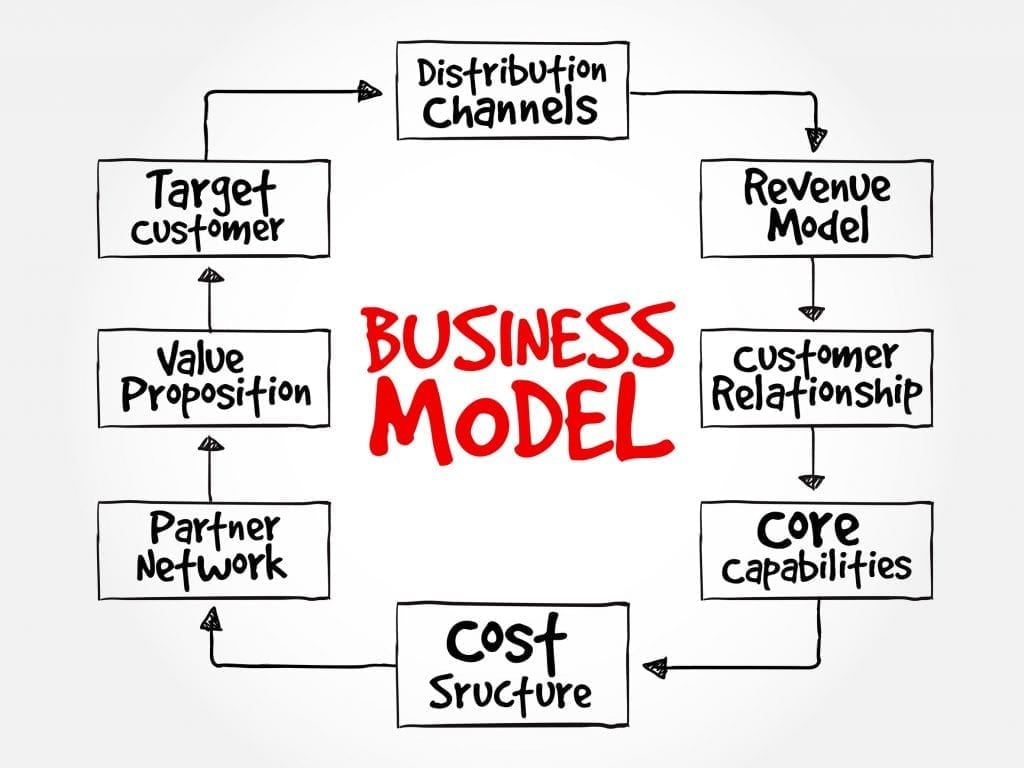

Let’s say you have thought through your business model using the business model canvas. You documented your business model. You identified customers, customer relationships, channels, value propositions, key activities, key resources, key partnerships, revenue, and costs, along with their relationships. It looks like a machine that will work. The open question is economic viability. You made a lot of assumptions as you developed your business model. You need to see if they function well together. You may have developed a prototype of your product or service. Now you need to develop a prototype of your venture.

You have a P&L of your business model. A P&L is very useful, but it does not capture the operating interrelationships of your business. It ignores time, for one.

What you need is an operating model of your business that produces financial results as a byproduct. Essentially, you need a virtual business. A good operations model will enable you to test your business model and predict the financial results of your operating assumptions.

The key to developing an operating model that truly models your business is to think in non-financial terms. Here are some examples:

- The number of customers acquired over time,

- The number of sales calls required to acquire a customer,

- The number of internet ad impressions required to acquire a customer,

- The reseller sales productivity,

- The number of resellers acquired over time,

- The volume of products purchased per customer,

- The raw materials needed to produce one product,

- The length of your supply chain in terms of time,

- The people and time needed to provide the services delivered to one customer,

- And so on.

The list of non-financial factors will be different for each business. The key is that, within the operational model, you are forecasting the physical business. You are not forecasting financials. The financials are the result of business operations. This is a test of your business model that can be done before you make large investments and before you fail fast.

Since you can adjust operational levels in the model to test different sets of assumptions, the financial results will tell you what operational levels you need to reach to achieve success. These can be sales productivity, pricing, renewal rates, and so on. Then you can evaluate each of these operational assumptions to see if they are reasonably achievable.

If all operational levels are achievable, you have a viable business model. Additionally, the model will give you key insights such as how much cash you will need before the business generates enough cash to support itself, what the return is to you and any potential investors, and what your venture might eventually be worth. Once you start operations, the model will help with decisions you need to make and serve as a planning tool. It will keep your virtual business ahead of your real business. You don’t have to be a visionary to have great vision.