Find the Right Type of Investor for your Stage of Growth

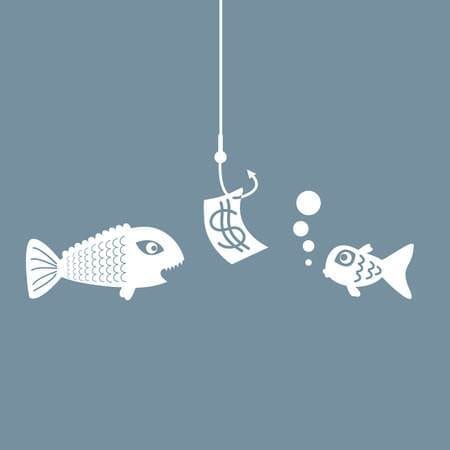

If you are looking for an outside investor, you need to know how they see you. Different types of investors look for startups at different levels of maturity. If your startup is at the wrong stage for the investor you are approaching, fishing for money is a waste of time for both of you.

For instance, if your company is only a few weeks old and you have zero customers and your product offering is still in design, don’t expect someone to hand over $10 million to fund your efforts. It wouldn’t work anyway, since your valuation at that stage would be less than the funding, meaning you would have to give away all ownership for the money.

You also will find that the stage your startup is in dictates where you go to seek funding. Funding sources specialize in certain growth stages. Angel investors typically provide early-stage funding, while venture capital firms typically come in at later stages.

Of course, growth and development are really a continuum. Yet most investors will tend to categorize your progress into one of the following five stages:

- Idea stage. This is the initial excitement period, the time when you dream of riches and fantasize the life of a business owner, but you have no real plan. At this stage, no professional investor will touch you unless you have a beautiful track record of success with previous startups. Funding will only come from you, or friends, family, and fools.

- Early or embryonic stage. Investments at this stage are typically called seed investments. Funding of $250,000-$1 million is available from angels, if you have credentials and have done the homework of a good business plan, financial model, and executive presentation. Anything less the $250,000, or any amount at this stage with no credentials, still has to come from friends and families, loans, or federal grant sources.

- Funding or rollout stage. This is the realm of venture capital professional investors, with funding amounts of $1-10 million, often referred to as the “A-round,” or first institutional funding. At this stage, your startup better be selling a commercial offering, have price and cost validated, with significant customer sales and a real revenue stream. Lesser amounts remain in the angel realm.

- Growth stage. Additional funding rounds for growth are often called the “B-round” through “G-round”, with each being in the $5 million to more than $50 million from venture capital and other sources. Companies at this stage must have a large market, good traction, and be focused on scaling infrastructure and market adoption. This normally means more than 30 employees, and more than $1 million in revenue.

- Exit stage. This is the final stage of investment in venture opportunities, and is the point where investors expect to see the return and gain from the original investment. At this stage, you need investment bankers to negotiate a merger or acquisition (M&A), go private, or help you go public with an Initial Public Offering (IPO).

As startups pass through each stage, they must attract appropriate financial partners that can provide the increasing credibility, capital, and industry networks to support movement to the next stage. Typically, they must also change and tune their executive team, to keep up with the increasing demands of a growing company on process discipline and sustainable success.

Another important thing to remember when selecting investors is that not all money is the same. VC money, for example, usually comes with high expectations of milestones met, board seats, and dominant control. Angels may be less demanding, but typically add less value. Friends and family hopefully believe fully in you, and just want you to show them success.

Obviously, if you bootstrap your business, you can avoid all these stages and the investment implications. Otherwise, not paying attention to the expectations associated with each stage will likely jeopardize your one chance to make a great first impression on potential investors, and landing the big one. Do it right and enjoy the journey.